Our Insights

Queensland Rents Break Records — Even Surpassing Sydney

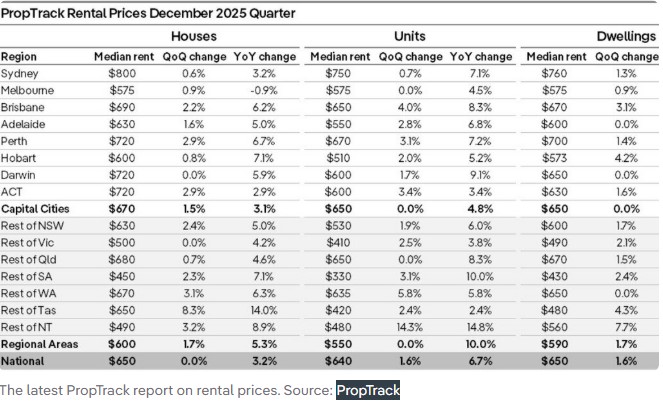

Australia’s rental market continues to tighten, and the latest data shows that renters across Queensland are now feeling the squeeze harder than ever before. In a striking turnaround, median rents in some Queensland markets are now even higher than Sydney, traditionally Australia’s most expensive city for renters.

According to the latest realestate.com.au Market Insight, the Gold Coast’s median weekly rent has surged to approximately $850 surpassing Sydney’s $760 median and setting a new benchmark for the state. Meanwhile, Brisbane and regional Queensland are now averaging around $670 per week, reflecting strong demand statewide and limited rental supply.

Rental growth for units in Brisbane exceeded that of houses in 2025

What’s Driving the Surge?

Several key factors are contributing to this historic rise in rental prices:

Strong population growth and interstate migration

Queensland’s lifestyle appeal sunny weather, more affordable housing relative to other coastal capitals, and employment opportunities continues to attract new residents. This influx increases competition for rental homes, especially in highly desirable areas like Brisbane and the Gold Coast.

Low vacancy rates

Rental availability remains tight throughout Queensland, with many areas experiencing sub-1% vacancy rates. When supply doesn’t keep pace with demand, landlords have more pricing power and renters have fewer choices.

Growth outpacing national trends

Across many markets nationally, rents are near all-time highs. In some cities, like Sydney and Perth, rents are still rising, while other regions are experiencing even faster growth. This dynamic has pushed the national median weekly rent to record levels, further amplifying affordability pressure.

What This Means For Renters

Rising rents are now devouring a larger share of household incomes, with many Queensland renters spending well over a third of their earnings just on accommodation. This trend is placing pressure on budgets and reducing discretionary spending especially for younger renters, families and those hoping to save for a home deposit.

What This Means For Investors and Property Owners

For property investors, rising rents and low vacancy rates can indicate strong rental demand and healthy returns particularly in growth corridors and lifestyle-driven markets like the Gold Coast and Greater Brisbane.

However, long-term success in the rental market still comes down to quality property selection, excellent maintenance, and professional management. Healthy demand today may evolve over time as new developments come online and economic conditions shift.

NEW RENT RECORDS:

BRISBANE

All dwellings Up 6.3%/yr to $670/wk

Houses Up 6.2%/yr to $690/wk

Units Up 8.3%/yr to $650/wk

REGIONAL QLD

All dwellings Up 6.3%/yr to $670/wk

House Up 4.6%/yr to $680/wk

Units Up 8.3%/yr to $650/wk

GOLD COAST

All dwellings Up 6.3%/yr to $850.

TOWNSVILLE

All dwellings Up 10%/yr to $550.

CAIRNS

All dwellings Up 8.7%/yr to $625/wk.

(Source: PropTrack)